One Big Beautiful Dangerous Bill

- Krishay Ray

- Sep 11, 2025

- 4 min read

4th of July 2025. It is American Independence Day, the cause of widespread celebration across the country. Although that is not all the celebrations are for. Mr. Trump, after months of intense debate, has finally had his flagship piece of legislation—the One Big Beautiful Bill (OBBB)—approved by Congress. Mr Trump has declared that it will inspire “great growth” for the economy and many in the US resonate with that view. However, that is just the tip of the iceberg. Look deeper and the bill is fraught with risks that threaten not just to derail the economy over time, but rip the delicate fabric of society as well - all under the guise of alluring short-term economic growth.

This potential for economic growth can be credited to a significant portion of the bill focused on extending the Tax Cuts and Jobs Act(TCJA) that Trump implemented in his first term. He has made numerous corporate and income tax breaks in the TCJA permanent, as they were set to expire by the end of this year. Firms and manufacturers have praised the bill for its many tax exemptions and financial incentives enabling them to reduce their costs; the corporate tax breaks are estimated to incentivise a 7% increase in corporate investment over the next 4 years, according to the White House Council for Economic Advisors. This higher level of investment coupled with potentially increased household spending levels promises to boost short-term economic growth by a little over 0.5% according to the Congressional Budget Office(CBO).

Although there is a large financial cost for such sweeping tax reductions. As much as Mr Trump wishes that America could generate money out of thin air, those tax cuts have to be financed by other expenditure reductions. Consequently, the bill reduces spending on Medicaid - health insurance for millions of poor Americans - by close to $1 trillion according to KFF, a think tank. Another such spending cut is the $300 billion cut to the Supplemental Nutrition Assistance Programme(SNAP), which gives food aid for over 40 million people. The bill will leave millions without affordable healthcare, food provisions, and lead to the closure of hundreds of nursing homes and rural hospitals - potentially fatal for those in life-threatening situations - that rely on Medicaid for funding. The reality for these underprivileged Americans is forecasted to be so bad that US representative Alexandria Ocasio-Cortez has called it “the largest and greatest loss of healthcare in American history”. Apart from leaving 12 million without health coverage, according to CBO reports, the bill also threatens to worsen wealth inequality even further. The top 20% of earners will increase their income by 3% while the poorest 25% will lose about 7.4% of their income by 2033 due to the OBBB, according to Penn Wharton. This is attributed to the income tax breaks heavily favouring the rich while the loss of Medicaid health insurance is a substantial financial loss for the poorer families. Despite the devastating social effects of such measures, the Big Beautiful Bill prescribes an additional $250 billion for the annual budget for the US military and Immigration and Customs Enforcement( a 1250% increase from its previous budget). Mr Trump may need to ask himself: Is pursuing a missile dome over America and detaining even more immigrants worth the loss of basic living needs for millions of American citizens?

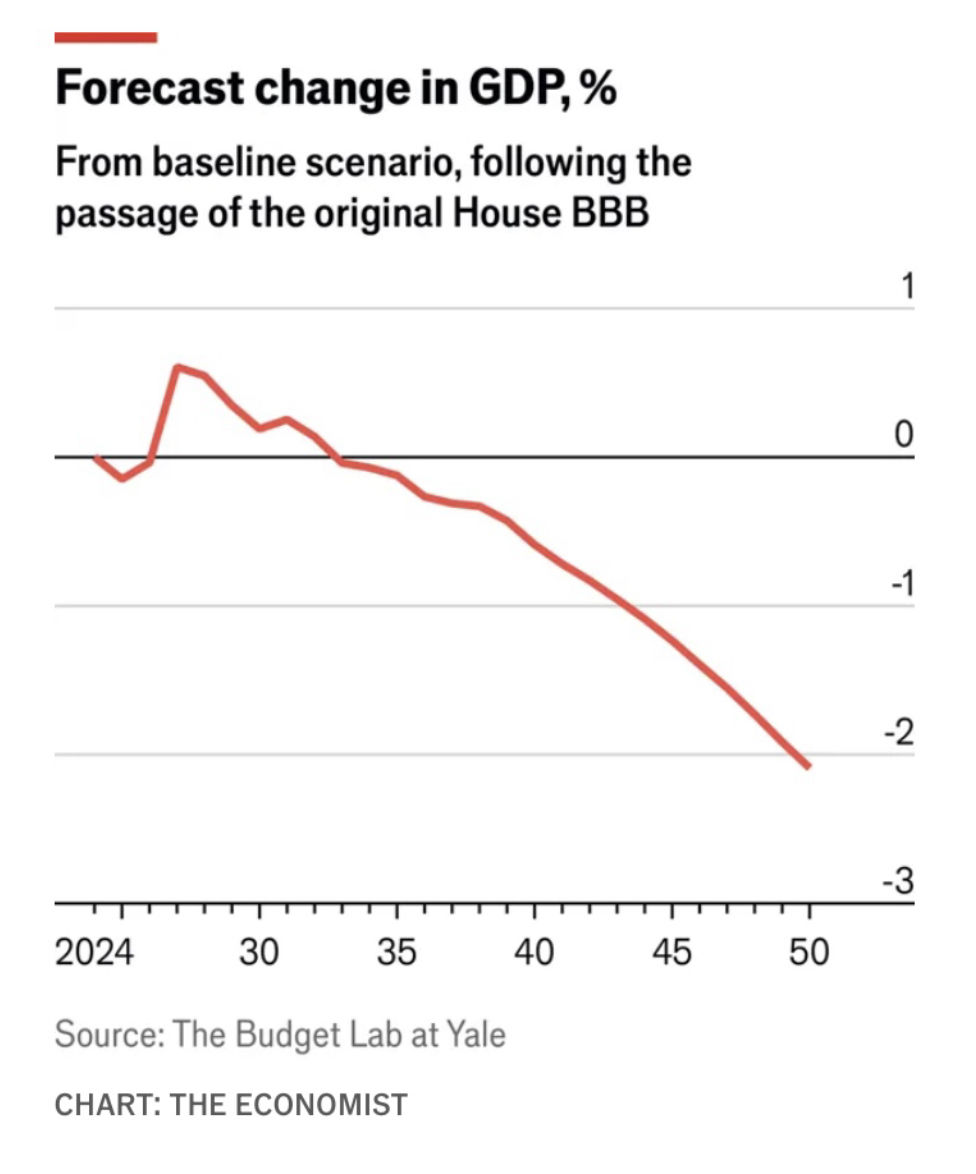

Yet this sacrifice will still not be enough to cover the costs. The entire bill is estimated to add over $5 trillion to the national debt, the CBO reports. And with the current government debt to GDP ratio already standing at over 124%, levels not seen since World War 2, there are growing concerns about how much debt is too much. This excessive government debt is predicted to raise interest rates significantly due to a multitude of factors, such as increased risk of US bonds and the government needing to attract lenders with higher rates. Higher interest rates will only worsen the economy. Firstly, it will ‘crowd out’ private investment causing reduced long-term growth and productivity, as illustrated in Figure 1, as well as pushing up interest rates even higher. Higher interest rates will also impact households considerably by making mortgages and borrowing in general far more expensive. Not only that, but amplified interest rates will increase debt repayment costs by over $440 billion in the next decade, according to the CBO. This would have a range of consequences from high inflation(if the Federal Reserve decides to print money to pay off excess debt) to reduced spending on public services and a limited ability to obtain funds to deal with any emergencies or recessions in the future. While the disastrous scenario of the government defaulting on its debt is still highly unlikely, the fact that it has gone from the unimaginable to a possibility is a worrying prospect. Essentially, the severity of some of the possible repercussions makes the bill extremely ”fiscally irresponsible” says Erica York, the vice president of federal tax policy for the Tax Foundation.

There is still hope. There are good parts to this bill: the corporate tax cuts are specific and are likely to aid long-term economic growth and added investment, and therefore should be kept. Although it is crucial that lawmakers reinstate adequate levels of spending on critical social services while improving the budget deficit significantly, even if that means painful tax raises. It would also be beneficial if legislators closed tax loopholes and streamlined the very complicated tax laws created by the OBBB, as this would reduce additional spending on enforcing taxes.

In a speech to the press on the White House lawns on the 4th of July, Trump likened the bill to a “rocket ship”. Unless repairs to the OBBB are made, there is a likely scenario where that “rocket ship” comes crashing back down to earth with overflowing debt and social instability.

_edited.png)

Comments